Don’t Simply Retire. Have Something to Retire to.

Kai-Zen® offers you up to an additional 3 times more money to fund a unique cash accumulating life insurance policy using leverage.

2 Minute Video

Learn about Kai-Zen

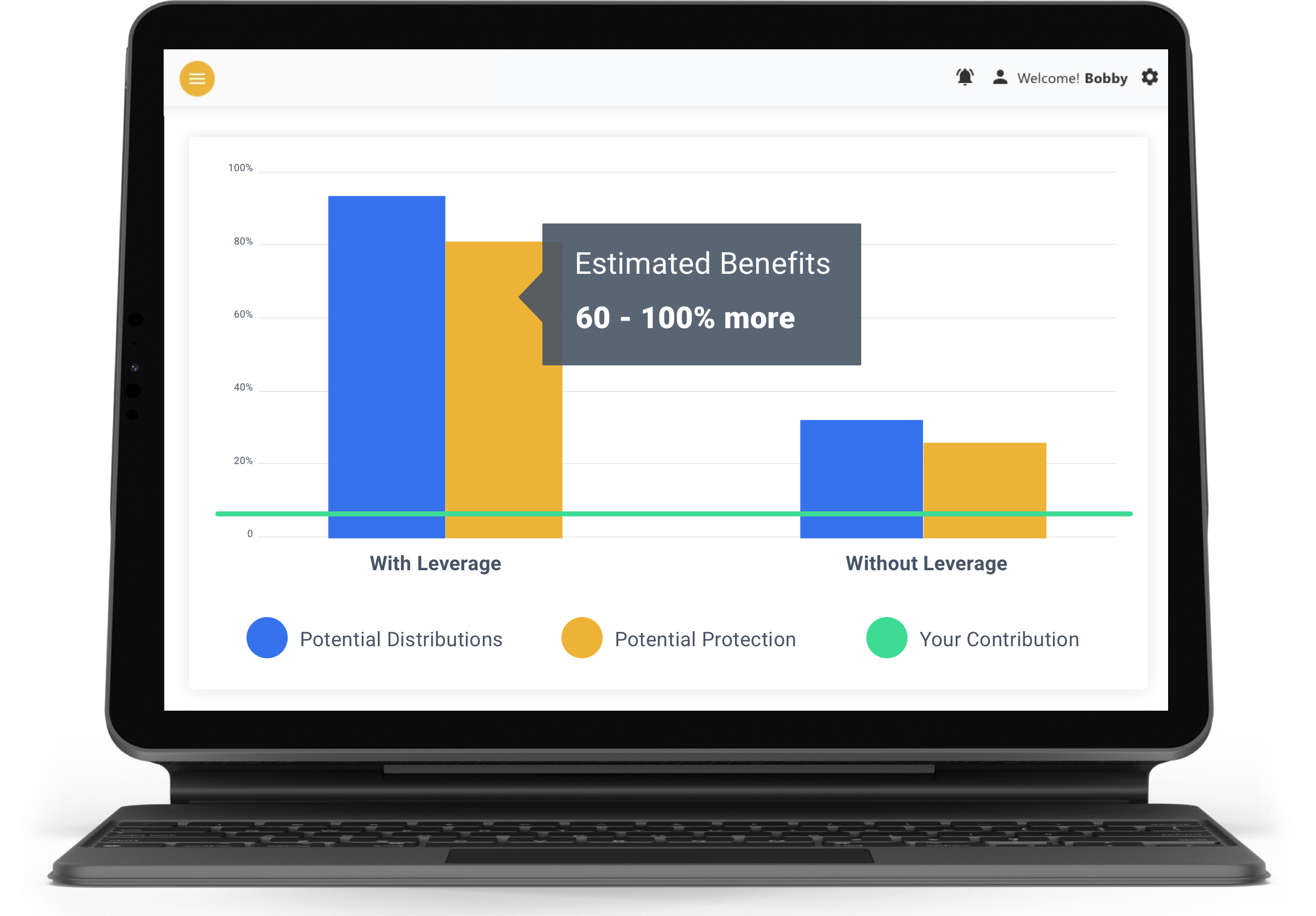

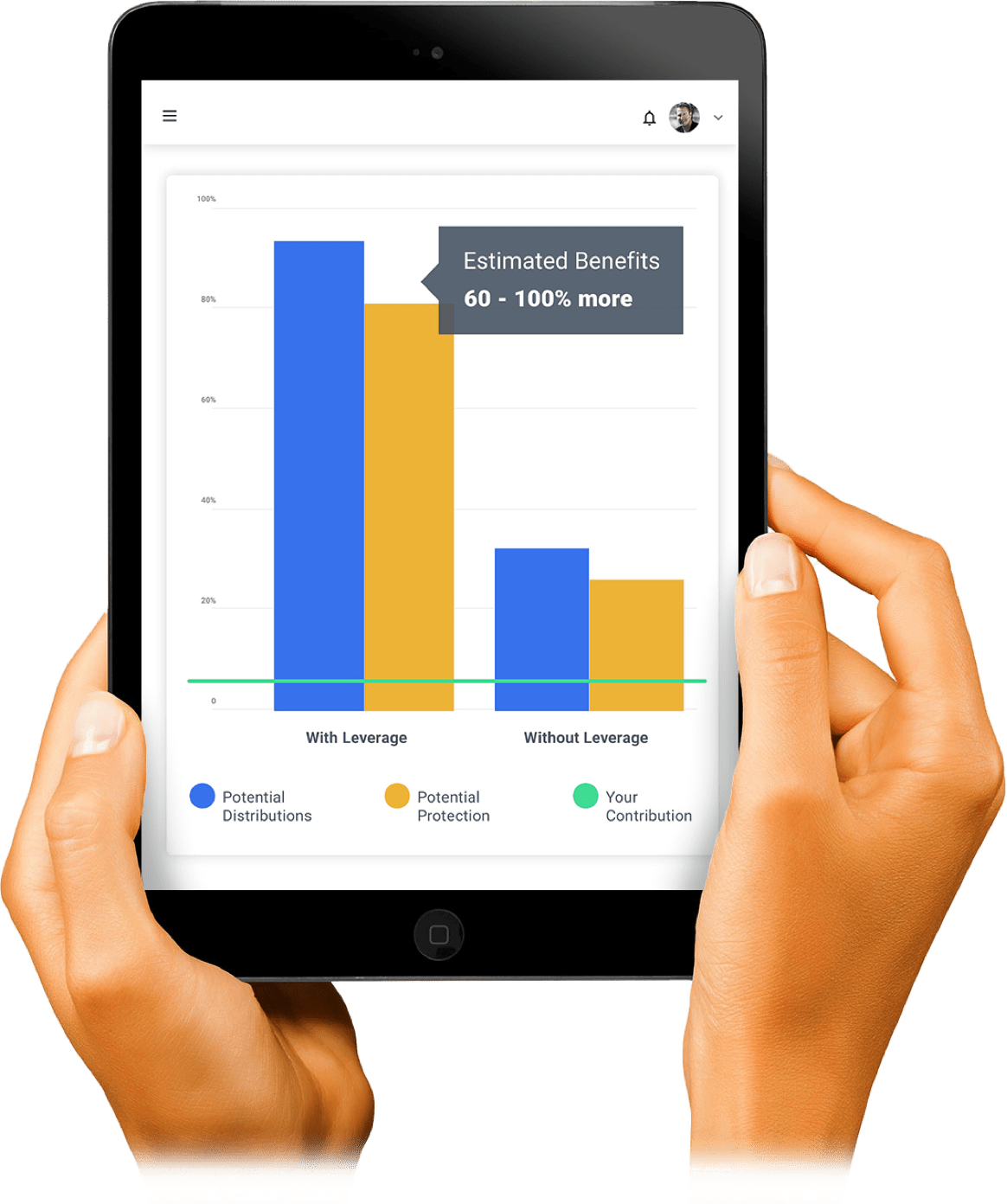

60 - 100%

More for Retirement

Free Benefits Estimate

Enter a few personal details to view your results.

contacted by a NIW specialist.

The success of your retirement depends on the amount you save, not on your rate of return. A unique cash accumulating life insurance policy using leverage offers an opportunity to earn interest and eliminate the risk of market declines, while providing you and your family protection. The policy secures the loan, providing you the potential for an additional 60-100% more for your retirement without the typical risks associated with leverage.

Why using leverage is smart.

We have all used leverage to purchase a nicer house or to buy a better car. Kai-Zen® uses leverage for the potential to accumulate more growth & obtain more protection, while providing the ability to maintain your current standard of living. That’s the smart way to use leverage.

- Potential for more accumulation.

- Maintain current lifestyle.

- More protection for you and your family.

- Diversify your assets.

Kai-Zen® is different!

Kai-Zen® is the only strategy that provides you the opportunity to add up to 3 times more money to fund a cash accumulating life insurance policy. Your contribution and the policy provide the security needed to obtain the loan and your participation is easy. Simply create an account, estimate your short 5-year annual contribution amount, and let Kai-Zen® leverage do the rest.

Kai-Zen® was designed to minimize expenses and maximize your potential for accumulation. We then combined it with leverage to provide you the potential for 60-100% more:*

- No credit checks

- No loan documents

- No personal guarantees

- No interest payments

- Death benefit

with living benefit riders.

- Chronic illness

- Terminal illness

- Upside crediting

(subject to cap)

- No negative returns

(no loss due to market declines)

- Tax-free distributions

(potential to access cash value using tax-free policy loans)

*The Kai-Zen® Strategy is dependent on the client making contributions for the first 5 years therefore not defaulting on the policy, which could result in policy lapse and surrender charges. The client will not have access to the policy, the cash values, the death benefits or the living benefits until the loan is repaid and the assignment is released. The lender has the right to discontinue funding new premiums, exit the market, or to demand loan repayment based on the terms and conditions signed by the Master Trust. See the Master Trust documents for additional information. There are some exceptions to this rule. Please consult a tax professional for advice concerning your individual situation.

Still wondering if Kai-Zen® is right for you?

Did you know, 90% of all households earning over $200,000 are chronically under saving for retirement in order to preserve their current quality of life. Source: Business Insider.

Americans are some of the worsts savers in the developed world saving on average only 6.5% for retirement.*

*Source: gen.medium.comKai-Zen® offers up to 3 times more money to what you are currently saving, making it easier for you to hit your goals.

If you currently earn $250,000 per year, you will need around $6,500,000 saved for retirement to maintain your current lifestyle.*

*Source: businessinsider.inKai-Zen® provides you the potential to increase the distributions you take home in retirement by an additional 60-100% more than what you would have without the use of leverage.

Many Americans are one medical emergency away from financial ruin. In fact 66.5% of all bankruptcies filed are due to health-care costs.*

*Source: cnbc.comKai-Zen® utilizes a policy that provides death benefit protection and living benefit riders. The riders can provide cash in the event of a qualifying chronic or terminal illness.

Learn more and get started.

Estimate your potential benefits to see how much more you could get with .